Following the Q1 2016 Global Travel Insights report that revealed Honolulu as the top five list of long-haul trips for Asia-Pacific travellers, Sojern looked deeper at Asia-Pacific’s interest in Hawaii as a vacation spot in order to understand the major travel trends for the tropical destination.

Within the top 10 origin countries, Asia-Pacific takes up three spots, which include Japan, South Korea and Australia. Two Asia-Pacific cities, Tokyo and Seoul, are in the top 10 origin cities for Hawaii.

Asia Pacific Countries are beginning to show a decline in travel to Hawaii. Only Bangkok is bucking the trend.

Although Asia-Pacific has a showing in the top origin markets, the region is beginning to show a decline in travel to Hawaii: Year over year, Taipei is showing a 48% decrease in travel intent to Hawaii; Sydney an 11% decrease; and Singapore a 6% decrease. Only Bangkok is bucking the trend with a 5% increase. The economic slowdown in the region, combined with the strong US dollar may be to blame for this year-over-year change.

What’s also unique about Asia-Pacific is in terms of trip duration and lead time. While the average search lead time is 104 days and the average trip eight days, the region has an average of 130 days lead time and nine days of travel. Continental Asia has an average of 110 days lead time and six days of travel. Knowing these differences can help you better plan your travel marketing tactics.

Timing Golden Week

This year, for the first time since 2011, Golden Week didn’t fall on a weekend. Sojern looked at travel trends from 2015 to 2016 Golden Week to see if the difference in dates impacted travel.

Top destinations, for instance, saw a bit of a shift:

- For 2015’s Golden Week, the top countries to visit included: the US, South Korea, Japan, China, and Hong Kong

- In 2016, the top countries were: the US, Japan, South Korea, Hong Kong, and China.

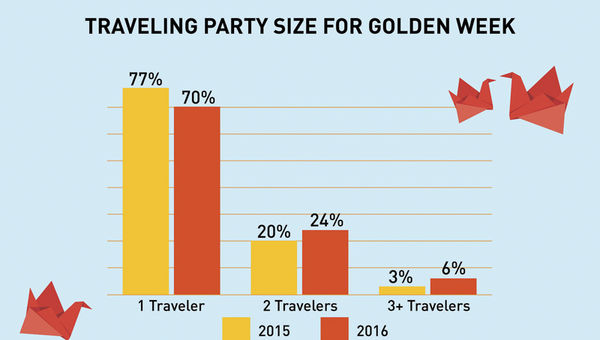

Chart showing the traveling party size for Golden Week Photo Credit: Tex and graphics courtesy of Sojern

Despite the fact that the holiday didn’t include the weekend as it usually does, long-haul travel still dominated the top cities to visit, though primarily in the US. 40% of the top 10 list is dominated by US cities, including Chicago and New York City.

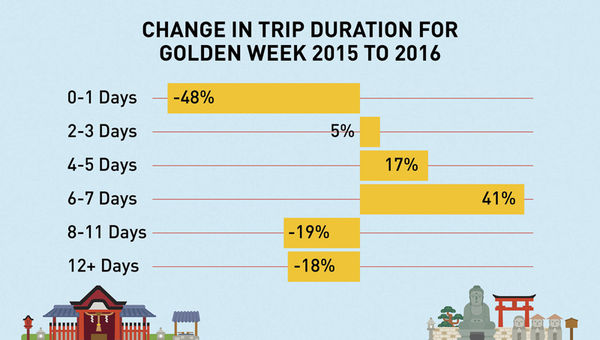

Chart showing the changes in trip duration for golden week 2015 to 2016 Photo Credit: Tex and graphics courtesy of Sojern

In addition to the change in timing for Golden Week, also noteworthy is the timing of booking and searching:

- More than 69% of the searching and booking happened two months before Golden Week

- Both searches and bookings peaked on on April 29, 2016

- April 27 saw the most long trips (12+ days) booked.

- May 3 saw the most short trips (2-3 days) booked.

Photo Credit: Tex and graphics courtesy of Sojern

Post-Ramadan Travellers Look Local

A number of holidays follow Ramadan and celebrate breaking the fast, including Hari Raya Puasa, Eid al-Fitr and the Sugar Feast.

These celebrations bring lots of travel to Asia-Pacific with June 30 and July 1 (the Thursday and Friday before the end of Ramadan) seeing the biggest spikes in travel intent. In April, 31% of South East travellers were planning on taking regional trips. Australia, Thailand and Taiwan were the top three destinations and 70% of the top 10 destination list was made up of regional locations. The UK, US, and France were the only three non-regional destinations to make the list.

Though nearby destinations are preferred, travellers weren’t looking exclusively for short trips. Trips of 0-3 days, for instance, only made up 17% of the trips, while roughly one-third of Asia-Pacific travellers are looking for trips that are four to seven days. The most popular trip duration, by a small margin, was trips for 12 or more days.